tesla tax credit 2021 georgia

With the two added the EV credit you get is 7500. Income Tax Credit Utilization Reports.

11th 2021 622 am pt.

. 48-7-4016 has been discontinued effective July 1 2015. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandonedThe EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Beginning on January 1 2021.

Every Ev And Its Range For Late 2021 Roadshow This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Rebates are available through December 31 2021. There are even more solar incentives.

At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of. For Teslas this isnt a problem as the minimum is well over this threshold. Federal Incentives All electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Income Tax Letter Rulings. So if someone wants a Rav4 Prime it would probably be best to purchase a new 2021 or 2022 model this year unless they dont owe enough taxes in 2021 to cover the 75K credit. Georgia Senate seeks smaller film tax credit limit UN.

The dates above reflect the extension. If the Build Back Better Act does not pass then I think the current 2021 tax credits would remain until the maximum number of cars sold is exceeded. Ive talked to my cpa trolled the internet and im still not satisfied.

The credit is 10 of the cost of the EVSE up to 2500 and cannot exceed the taxpayers income tax liability. 10 of the vehicle cost up to 2500 if you purchase or lease a low emission vehicle LEV. Qualified Education Expense Tax Credit.

A certification by the seller is required. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. 2021 georgia tesla wallpaper.

The effective date for this is after December 31 2021. Hufstetlers plan would create a flat rate of 499 in steps starting in 2024 with married couples making less than 20000 a. That includes Teslas Powerwall.

You could also be eligible for a tax credit of 5000 for buying or. Tesla tax credit 2021 georgia. Georgia Power customers may be eligible to receive up to a 250 rebate for installing a Level 2 Charger in their home.

Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. FAQ for General Business Credits. So no EV tax credit getting passed before end of 2021.

So based on the date of your purchase TurboTax is correct stating that the credit is not. 11th 2021 622 am PT FredericLambert Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV. The Senate wrapped up its work for the year with Democrats punting work on Build Back Better and a debate over changing the rules into 2022.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Georgia. 20 of the vehicle cost up to 5000 if you purchase or lease a. 20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Several months later it seems that revisions to the credit are returning to lawmaker agendas. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a.

If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of. Make the tax credit refundable meaning that someone with a tax liability of only 3500 could get the full benefit of the 7500 credit as they would receive a 4000 tax refund. Statutorily Required Credit Report.

Georgia Tax Center Information Tax Credit Forms. Updated March 2022. LowZero Emission Vehicles - The current GA Low Emission Vehicle LEV and Zero Emission Vehicle ZEV Certification Program OCGA.

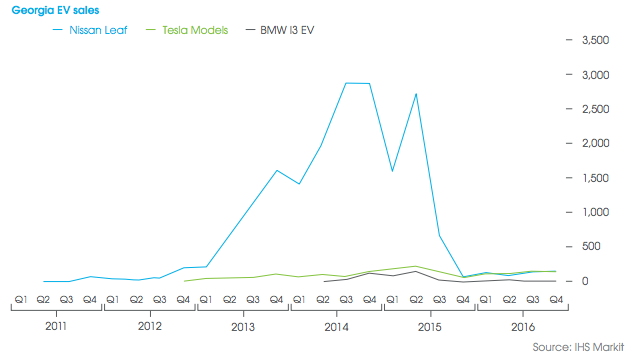

A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure. 4 million refugees have now fled Ukraine Trump urges Putin to release dirt on Hunter Biden. Georgia Tax Credit Prior to July 1 2015 Georgia allowed a generous tax credit for the purchase or lease of new BEVs.

Senate wraps for the year punting Build Back Better voting rights. Depending on your location state and local utility incentives may be available for electric vehicles and solar systems. Keep in mind that the itc applies only to those who buy their pv.

Tesla tax credit 2021 georgia Tuesday March 1 2022 A refundable tax credit is not a point of purchase rebate. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. EV Federal Tax Credit for 2021 Tesla.

State Local and Utility Incentives. Income Tax Credit Policy Bulletins. A refundable tax credit is not a point of purchase rebate.

On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour. The federal solar tax credit. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured.

Georgias top income tax rate is now 575. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. Low Emission Alternative Fuel Vehicle LEVZEV and Medium Heavy Duty Vehicle MDVHDV Tax Credits in Georgia.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. This credit was originally adopted by the state in 2001 three years before Tesla began development of its first model the Tesla Roadster and nine years before the introduction of the.

Tesla S Tsla Drop In Hong Kong Sales After The Expiration Of Tax Incentives Won T Really Matter For Electric Vehicles In The Long Run Quartz

Buy Tesla Model 3 Price Ppc Or Hp Top Gear

Tesla S Sales Slowed In 22 States Last Year Report Says The New York Times

Latest On Tesla Ev Tax Credit March 2022

These Electric Cars Deliver The Most Bang For The Buck

/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

Tesla Cost Of Ownership Is It Worth It

Georgia Ev Sales Leaf Tesla Bmwi3 Edmunds Evadoption

Charged Evs Parsing The Latest Proposal To Revamp The Federal Ev Tax Credit Charged Evs

The Looming Issue With Tesla S Model 3 Production Delay Greentech Media

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Tesla Toyota Accuse Biden S Ev Tax Credit Of Putting Unions Over The Environment

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tesla S Model 3 Won T Change The World And That S Ok Greentech Media

Latest On Tesla Ev Tax Credit March 2022

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags