how to purchase stocks and bonds

Some firms specialize in. Our Top Picks For Stock Brokers.

What S The Difference Between Bonds And Stocks Youtube

LOSERS watching stock market.

. That makes it important to have an alternative. In addition once you buy an I-Bond your money is tied up for at least a year unless you happen to live in a declared disaster area. Vanguard Long Term Investment Graded Fund.

A place where investors buy and sell to each other rather. The minimum requirement for buying a Treasury is usually 100 and goes up from. It typically takes minutes to fill out a brokers online application form.

One way to buy bonds is to go through an online broker like Schwab TD Ameritrade or Fidelity. Buying Bonds Through the US. So far in 2022 nine of the top ten firms with the largest gains in Canada are from the energy sector.

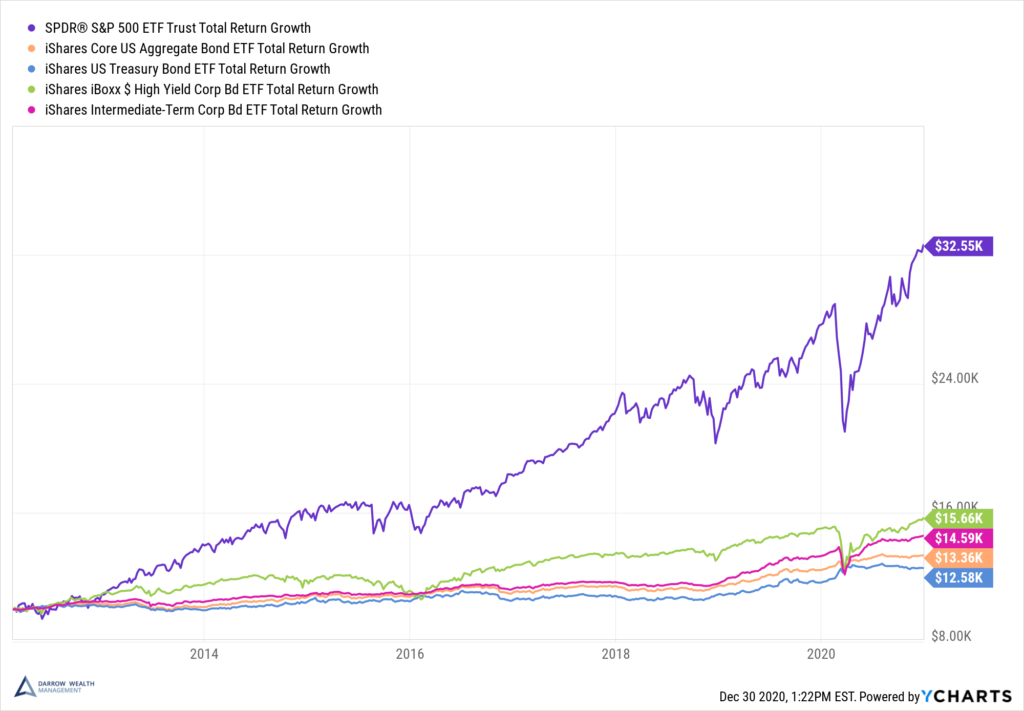

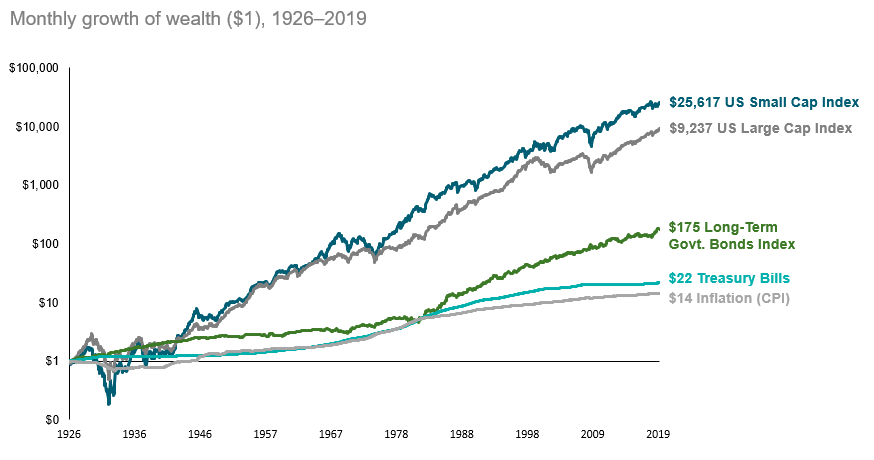

There are two ways to make money by investing in bonds. As a beginner you should stick with blue chip stocks and Treasury bonds or bills. For bonds purchasing on the primary market means you buy directly from the bonds issuer and pay face value.

Bond market 40 times larger than stock market. Launch your investing journey in 6 steps. Wide Range Of Investment Choices Including Options Futures and Forex.

When you take this approach you purchase bonds from other investors. Here your bid will only be accepted if it is less than or equal to the rate set by the auction. Bitget is The Best Place to Buy usdt Without Verification or ID Anonymously.

Ad Buy BTC ETH and USDT at Bitget and Begin Your Crypto Trading Journey Now. Real problem is in bond market. Where to Buy Stocks and Bonds Stocks are well known for being sold on various financial exchanges in the United States the most popular exchanges are the New York.

The first step to launching your investing journey is to enroll in a MoneyLion. Ad These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. If you buy a 1-year bond the bank says Hey if you lend me 100 well give you 102 back in a year.

Ad Were all about helping you get more from your money. The first is to hold those bonds until their maturity date and collect interest payments on them. Online brokers perform offer investment-related links research and assets.

You can buy new Treasury bonds online by visiting Treasury Direct. You can invest in funds just as easily as you can invest in stocks. Ad Join 20M users on Robinhood today and get a free stock on us.

In terms of the bond maturity this is simply the date that the bonds will expire. Oil mining and financial stocks comprise over 60 of the Canadian market. Enroll in a MoneyLion Zero-Fee Bank Account.

Therefore a 1000 bond with a coupon rate of 5 pays 50 interest each year. A bond is a fixed income investment in which an investor loans money to an entity typically corporate or governmental which borrows the funds for a defined period of time at a variable. Wide Range Of Investment Choices Including Options Futures and Forex.

Invest in Stocks Options ETFs with Robinhood Financial and Crypto with Robinhood Crypto. Rather than use your brokerage account to buy I bonds youll purchase them directly from the US. One of the most common and easiest ways of buying and.

Open a Brokerage Account. Lets take a look at the 7 best funds for retirees. Buying anything but Treasuries and savings bonds typically requires using a broker.

Create a Treasury Direct account. The first step is to open a brokerage account that allows you to buy bonds. Please pay attention to bonds not stocks.

You can buy virtually any type of bond or bond fund through a brokerage firm. A blue chip stock is a stock that has a history of yielding a fair return. The only assistance an individual will usually obtain is technical assistance.

To set up a Treasury Direct account you must be 18 or. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. The approximate current rate of return for a 2-year bond is.

Bond interest is usually. Lets get started today. 1 day agoSee the picks.

The coupon rate on the bonds is 5. Bond yield is essentially the rate of return the bond generates for the investor on the purchase. From Novice To Expert Compare Brokers To Trade Stocks.

Stocks Vs Bonds Differences In Risk And Return Make A Case For Both

Stocks Vs Bonds What You Need To Know Experian

Bonds Vs Stocks Overview Characteristics Example

What It Means To Buy A Company S Stock Video Khan Academy

Financing With Stocks And Bonds St Louis Federal Reserve

Stocks And Bonds Russell Investments

Start Investing In Stocks A Step By Step Guide For Beginners

Stocks Vs Bonds What S The Relationship How Do Prices Move

The Proper Asset Allocation Of Stocks And Bonds By Age

Stocks Vs Bonds Differences In Risk And Return Make A Case For Both

Ways To Invest Money Understanding Your Investment Choices

Financing With Stocks And Bonds St Louis Federal Reserve

How To Buy Stocks A Step By Step Guide Forbes Advisor

Stocks Vs Bonds What S The Relationship How Do Prices Move

Stocks Vs Bonds What S The Relationship How Do Prices Move

Investing In Stocks Bonds What Are Stocks Bonds Video Lesson Transcript Study Com

/dotdash_Final_Common_Stock_2020-01-03fbeb0664c74b71aa025dcfd7661c82.jpg)

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)